Buying a car is a big decision, but have you ever really thought about how much itactuallycosts you over the years? We're not just talking about the sticker price. Fuel, maintenance, insurance, and even depreciation all play a role. Understanding the true cost can save you thousands and steer you towards the smartest choice for your wallet and the planet.

The initial excitement of driving a new car can quickly fade when you're constantly filling up at the gas station or facing unexpected repair bills. The environmental impact is also a growing concern for many, adding another layer of complexity to the decision-making process.

This post dives deep into the total cost of ownership for different types of vehicles: traditional gasoline cars, hybrid vehicles, and electric vehicles (EVs). We'll break down all the factors that contribute to the overall expense, helping you make an informed decision based on your individual needs and driving habits. By comparing these vehicles, we'll shed light on the financial and environmental implications of each choice, empowering you to choose the vehicle that best aligns with your budget and values.

In the end, calculating the total cost of owning a car requires more than just looking at the purchase price. We'll explore fuel costs (or electricity costs), maintenance schedules, insurance rates, depreciation, and potential tax incentives. By comparing gasoline, hybrid, and electric vehicles across these categories, you'll gain a clear understanding of the long-term financial implications of each option and make a truly informed decision.

The Upfront Cost vs. Long-Term Savings

My brother recently went through this very dilemma. He was dead set on a shiny new SUV, but after we sat down and crunched the numbers, the allure quickly faded. He hadn't considered the sky-high gas prices, the more frequent oil changes, and the faster depreciation compared to a hybrid or even a smaller, more fuel-efficient gas car. The upfront cost of the SUV was appealing, but thelong-termexpenses were a major turnoff.

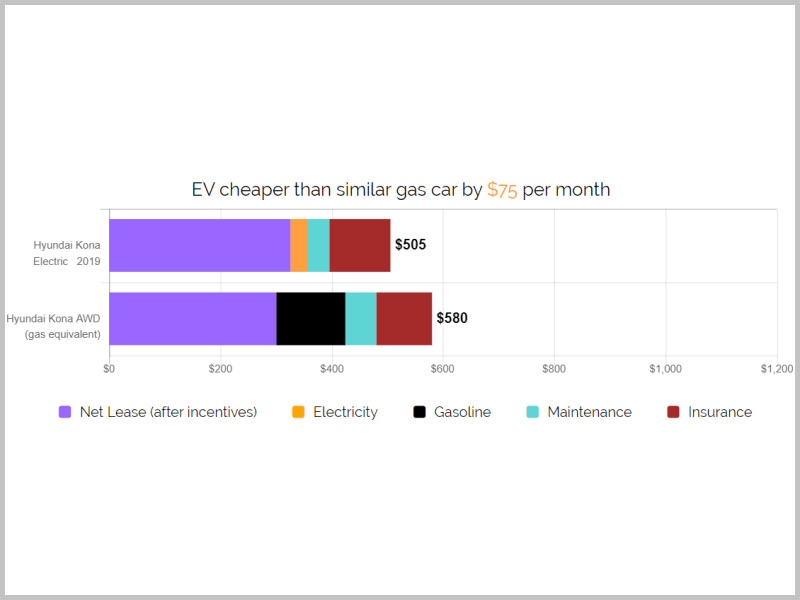

The initial price tag is often the first thing that catches our eye, but it's crucial to look beyond that. Electric vehicles, for example, often have a higher purchase price than comparable gasoline cars. However, significant savings can be realized over time thanks to lower fuel costs (electricity is generally cheaper than gasoline), reduced maintenance (EVs have fewer moving parts), and potential government incentives. Hybrids offer a middle ground, combining the benefits of both gasoline and electric powertrains, resulting in better fuel economy than traditional cars and lower emissions. Factors such as federal tax credits, state rebates, and local incentives can drastically reduce the upfront cost of an EV, making it a more competitive option. Battery life and potential replacement costs are also important considerations, as are the availability and cost of charging infrastructure.

Breaking Down Fuel and Energy Costs

Fuel or "energy" costs are perhaps the most obvious ongoing expense. Gasoline prices fluctuate wildly, leaving drivers vulnerable to market volatility. Electric vehicles, on the other hand, offer more stable and predictable energy costs. While electricity prices also vary, they generally remain lower than gasoline prices per mile driven. Hybrids, with their combination of gasoline and electric power, provide a buffer against fluctuating gasoline prices, achieving significantly better fuel economy than conventional gasoline cars. The way you drive also plays a big role; aggressive acceleration and high speeds consume more fuel or electricity, regardless of the vehicle type. Regular maintenance, such as tire inflation and filter changes, can also optimize fuel efficiency. Plug-in hybrids offer even more control, allowing you to drive solely on electric power for shorter commutes, further reducing your reliance on gasoline.

Maintenance and Repair Considerations

One of the biggest advantages of electric vehicles is their simplified mechanical design. With fewer moving parts, EVs require less frequent maintenance and have a lower risk of breakdowns. There are no oil changes, spark plugs, or exhaust systems to worry about. Hybrids, while still having a gasoline engine, often have regenerative braking systems that extend the life of brake pads. Traditional gasoline cars, with their complex engines and transmissions, typically require more frequent maintenance and are more prone to costly repairs. Routine maintenance schedules for each type of vehicle differ significantly, with EVs generally needing only tire rotations and occasional fluid top-ups. The lifespan of the battery in an EV is a major concern for some, but battery technology has improved dramatically in recent years, and most manufacturers offer lengthy warranties. Understanding the maintenance requirements and potential repair costs for each vehicle type is crucial for accurate cost of ownership calculations.

Depreciation and Resale Value

Depreciation, the loss of value over time, is often an overlooked aspect of car ownership. All vehicles depreciate, but the rate at which they do so varies depending on the make, model, and overall market demand. Electric vehicles have historically depreciated faster than gasoline cars, but this trend is changing as EV technology becomes more mature and demand increases. Hybrids generally hold their value well, thanks to their fuel efficiency and reliability. The resale value of a vehicle is influenced by factors such as mileage, condition, and the availability of newer models. Understanding depreciation rates and resale values is essential for estimating the true cost of ownership over the lifespan of the vehicle. Online resources and industry reports can provide valuable insights into the depreciation trends of different vehicle models. Keeping your car in good condition through regular maintenance can also help maximize its resale value.

Insurance Costs and Potential Tax Incentives

Insurance Premiums: What to Expect

Insurance rates vary depending on a multitude of factors, including your driving record, location, and the type of vehicle you own. Electric vehicles and hybrids may have slightly higher insurance premiums due to their higher purchase price and the cost of repairing advanced technology. However, some insurance companies offer discounts for eco-friendly vehicles. Gasoline cars, with their higher accident rates, may also have higher insurance costs. Comparing insurance quotes from different providers is crucial for finding the best rates. Bundling your car insurance with other policies, such as home insurance, can also result in significant savings. Understanding the factors that influence insurance premiums can help you make an informed decision about the type of vehicle to buy.

Tips for Calculating Your True Cost of Ownership

Calculating the total cost of ownership can seem daunting, but there are several tools and resources available to help you. Online calculators, such as those provided by Edmunds and Kelley Blue Book, allow you to input specific vehicle information and estimate the long-term expenses. Consider all the factors we've discussed, including fuel or energy costs, maintenance, insurance, depreciation, and potential tax incentives. Be realistic about your driving habits and the number of miles you drive each year. Factor in the cost of charging equipment for electric vehicles, such as home chargers or public charging fees. Regularly track your expenses and adjust your calculations as needed. By carefully considering all the variables, you can get a clear picture of the true cost of owning a particular vehicle.

Detailed Cost Breakdown: A Checklist

Start with the purchase price (or lease payment). Estimate annual fuel/electricity costs based on your driving habits and local prices. Research average maintenance costs for the specific vehicle model. Obtain insurance quotes from multiple providers. Use online tools to estimate depreciation over your planned ownership period. Factor in any applicable tax credits, rebates, or incentives. Consider the cost of charging equipment for EVs. Don't forget to account for registration fees, taxes, and any other miscellaneous expenses. Review your calculations regularly and adjust as needed. By following this checklist, you can create a comprehensive cost of ownership analysis.

Fun Facts About Vehicle Ownership Costs

Did you know that the average American spends thousands of dollars on car ownership each year? Or that electric vehicles can actually save you money in the long run, despite their higher upfront cost? The cost of gasoline has a significant impact on consumer spending, especially during periods of high prices. Many people underestimate the true cost of owning a car, focusing solely on the purchase price. Hybrids are becoming increasingly popular as consumers seek fuel-efficient and environmentally friendly options. The used car market offers a wide range of affordable vehicles, but it's essential to factor in potential maintenance and repair costs. By staying informed about vehicle ownership costs, you can make smarter financial decisions.

How to Minimize Your Vehicle Ownership Costs

Drive conservatively and avoid aggressive acceleration. Maintain your vehicle regularly to optimize fuel efficiency and prevent costly repairs. Shop around for the best insurance rates. Consider purchasing a used vehicle to save on depreciation. Take advantage of tax credits and rebates for electric and hybrid vehicles. Choose a vehicle that meets your needs but doesn't exceed your budget. Minimize unnecessary driving by combining errands and using public transportation when possible. Inflate your tires to the recommended pressure to improve fuel economy. By implementing these strategies, you can significantly reduce your vehicle ownership costs.

What If Gas Prices Skyrocket?

If gasoline prices were to skyrocket, the financial benefits of owning an electric or hybrid vehicle would become even more pronounced. EVs would offer a significant advantage, as electricity prices are less volatile and generally lower than gasoline prices. Hybrids would also fare better than traditional gasoline cars, thanks to their superior fuel economy. Consumers might experience a surge in demand for electric and hybrid vehicles, driving up their prices and potentially making them more difficult to find. Government incentives for electric vehicles could become more generous, further encouraging adoption. The overall cost of transportation would increase, impacting various sectors of the economy. In such a scenario, owning an efficient and fuel-conscious vehicle would be more important than ever.

Top 5 Ways to Save Money on Car Ownership

1. Choose a fuel-efficient vehicle (hybrid or electric).

- Drive conservatively and maintain your car regularly.

- Shop around for the best insurance rates.

- Consider purchasing a used vehicle.

- Take advantage of tax credits and rebates.

Question and Answer Section

Q: Are electric vehicles really cheaper to own than gasoline cars?

A: While the initial cost of an EV may be higher, the lower fuel and maintenance costs can often result in significant long-term savings.

Q: How much does it cost to install a home charger for an EV?

A: The cost of installing a home charger can vary depending on the type of charger and the complexity of the installation, but it typically ranges from a few hundred to a few thousand dollars.

Q: Do hybrids require more maintenance than gasoline cars?

A: Not necessarily. Hybrids often have regenerative braking systems that extend the life of brake pads, and their gasoline engines are typically smaller and more efficient.

Q: What are the best resources for comparing the total cost of ownership of different vehicles?

A: Online calculators such as those provided by Edmunds and Kelley Blue Book can be helpful, as well as government websites and industry reports.

Conclusion of Cost of Ownership: Comparing Hybrids to Electric Vehicles and Gas Cars

Making the right choice for your next vehicle involves more than just falling in love with the latest model. It's about understanding the long-term financial implications and aligning your purchase with your lifestyle and values. By carefully considering fuel costs, maintenance needs, insurance rates, depreciation, and available incentives, you can confidently choose the vehicle that best fits your budget and helps you achieve your financial goals. Whether you opt for the fuel efficiency of a hybrid, the clean energy of an EV, or the familiarity of a gasoline car, a well-informed decision is the key to a happy and cost-effective car ownership experience.