Buying a car is a big decision, and it's not just about the sticker price. We all know that shiny new car smell fades, but the expenses? Those stick around for years. Figuring out which type of vehicle will truly save you money in the long run—gas guzzler, hybrid, or fully electric—can feel like deciphering a secret code.

Many car buyers wrestle with concerns beyond the initial purchase price. They worry about fluctuating fuel costs, unexpected repair bills, and the potential for rapid depreciation. The environmental impact also weighs heavily on the minds of many, making the choice even more complex. Navigating these factors can be overwhelming, leaving potential buyers feeling unsure about making the right decision for their wallets and the planet.

This post aims to break down the total cost of ownership for different types of vehicles – gasoline cars, hybrids, and electric vehicles (EVs) – helping you make an informed decision that aligns with your financial goals and driving needs. We'll delve into the various factors that contribute to the overall cost, including purchase price, fuel/electricity costs, maintenance, insurance, and potential tax incentives.

Ultimately, the true cost of owning a vehicle goes far beyond the initial price tag. Understanding the long-term financial implications of fuel or electricity, maintenance schedules, and potential tax benefits is crucial for making an informed decision. Whether you prioritize upfront savings, environmental responsibility, or overall long-term value, this guide will help you navigate the complexities of vehicle ownership and choose the right car for your individual circumstances. We'll cover key factors like depreciation, insurance, and even potential resale value to give you a comprehensive picture.

My First Hybrid and the Unexpected Savings

My first foray into the world of alternative vehicles was with a hybrid. I remember being initially hesitant, lured by the lower price tags of traditional gasoline cars. The up-front cost of the hybrid seemed significant. However, after a few years of ownership, I was shocked by how much I was saving. It wasn’t just the fuel economy, which was a major win, but also the reduced maintenance. Hybrid brakes last longer, and the regenerative braking system meant less wear and tear overall. The experience really opened my eyes to the importance of considering the entire ownership picture, not just the initial price. Now, when helping friends and family navigate their car-buying decisions, I always emphasize looking at the long game – the total cost of ownership – including fuel/electricity costs, maintenance, insurance, and potential tax incentives. This experience profoundly shaped my perspective, proving that investing in a hybrid, and eventually an EV, was a financially sound and environmentally conscious decision.

Understanding Total Cost of Ownership

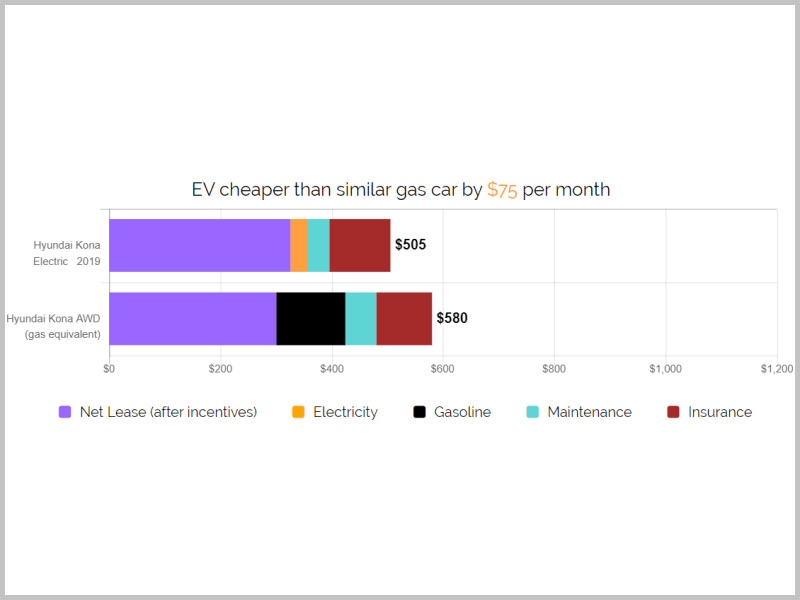

Total Cost of Ownership (TCO) is a comprehensive calculation that goes beyond the initial purchase price of a vehicle. It encompasses all expenses associated with owning and operating a car over its lifespan, typically five to seven years. By understanding TCO, you can make a more informed decision about which vehicle is the most financially sound option for your needs. This calculation includes factors such as depreciation, fuel or electricity costs, maintenance and repair expenses, insurance premiums, taxes, and fees. For example, while an electric vehicle may have a higher upfront cost than a gasoline car, its lower fuel and maintenance costs can often result in a lower TCO over time. Similarly, a hybrid vehicle may offer a balance between the two, providing better fuel economy than a gasoline car while avoiding the range anxiety associated with some EVs. Accurately calculating TCO requires careful consideration of your driving habits, local fuel or electricity prices, and the specific characteristics of each vehicle you are considering.

The Myths and History of Cost of Ownership

One common myth is that electric vehicles are significantly more expensive to own than gasoline cars, regardless of usage. Historically, this might have been true due to the higher initial purchase price of EVs and concerns about battery life. However, advancements in battery technology and increasing production volumes have driven down EV prices, while government incentives and tax credits can further reduce the upfront cost. Furthermore, the long-term operating costs of EVs are often lower than those of gasoline cars due to reduced fuel and maintenance expenses. The history of TCO analysis reveals that the methodology has evolved over time to include a wider range of factors, such as environmental costs and social benefits. Early TCO models primarily focused on direct financial costs, but more recent approaches incorporate externalities such as air pollution and greenhouse gas emissions. By considering these broader factors, TCO can provide a more holistic assessment of the true cost of vehicle ownership.

Unlocking the Hidden Secrets of TCO

One of the hidden secrets of TCO is the impact of driving habits and location. For example, if you primarily drive short distances in urban areas, an EV may be a particularly cost-effective choice due to its regenerative braking system and ability to charge at home. On the other hand, if you frequently drive long distances on highways, a hybrid vehicle may be a better option due to its longer range and ability to refuel quickly. Similarly, electricity prices vary significantly depending on your location, which can affect the overall cost of charging an EV. Another hidden factor is the potential for unexpected maintenance or repair expenses. While EVs generally require less maintenance than gasoline cars, battery replacements can be costly. Therefore, it's important to research the battery warranty and potential replacement costs before purchasing an EV. By carefully considering these hidden factors, you can gain a more accurate understanding of the true cost of owning different types of vehicles.

Recommendations for Calculating Your TCO

When calculating TCO, it's essential to gather accurate and up-to-date information. Start by researching the purchase price of the vehicles you are considering, including any available incentives or tax credits. Next, estimate your annual mileage and driving habits, as this will affect your fuel or electricity costs. Use online tools and resources to calculate the estimated fuel economy or energy consumption of each vehicle. Research the maintenance schedules and repair costs for each vehicle, paying attention to potential battery replacement costs for EVs. Obtain insurance quotes from multiple providers to compare premiums. Finally, factor in any applicable taxes, fees, and registration costs. To make the process easier, consider using a TCO calculator or spreadsheet. These tools can help you organize your data and compare the TCO of different vehicles side-by-side. Be sure to update your assumptions and estimates as needed to ensure that your TCO calculation remains accurate.

Depreciation: The Silent Killer of Value

Depreciation is the decline in a vehicle's value over time, and it's often the largest expense associated with vehicle ownership. Depreciation rates vary depending on the type of vehicle, its condition, and market demand. Gasoline cars tend to depreciate more quickly than hybrids and EVs, particularly in the early years of ownership. However, the depreciation rates of EVs have been improving in recent years due to increasing demand and advancements in battery technology. To minimize depreciation, consider buying a used vehicle, as it will have already experienced its steepest decline in value. Choose a vehicle with a strong reputation for reliability and resale value. Keep your vehicle in good condition by following the maintenance schedule and addressing any repairs promptly. Finally, be aware of market trends and adjust your expectations accordingly.

Tips for Reducing Your TCO

There are several strategies you can use to reduce the total cost of owning a vehicle. First, consider buying a used vehicle instead of a new one, as this can save you thousands of dollars on the purchase price. Second, choose a fuel-efficient or energy-efficient vehicle that aligns with your driving habits. Third, maintain your vehicle properly by following the maintenance schedule and addressing any repairs promptly. Fourth, shop around for insurance quotes and compare premiums from multiple providers. Fifth, take advantage of any available incentives or tax credits for purchasing an EV or hybrid vehicle. Sixth, drive responsibly to reduce fuel consumption and avoid accidents. Seventh, consider using public transportation, cycling, or walking for short trips. By implementing these strategies, you can significantly reduce your TCO and save money over the lifespan of your vehicle.

Negotiating the Best Price

Negotiating the best price on a vehicle is crucial for reducing your TCO. Start by researching the fair market value of the vehicle you are interested in. Obtain quotes from multiple dealerships and compare prices. Be prepared to walk away if the dealer is not willing to offer a competitive price. Don't be afraid to negotiate on the trade-in value of your old vehicle as well. Consider purchasing at the end of the month or quarter, as dealerships may be more willing to offer discounts to meet sales targets. Be polite but firm in your negotiations, and don't be afraid to ask for additional incentives or discounts.

Fun Facts About Vehicle Ownership Costs

Did you know that the average car spends about 95% of its time parked? This means that a significant portion of the cost of owning a vehicle is associated with depreciation and insurance, even when you're not using it. Another fun fact is that the cost of gasoline can vary significantly depending on your location and the time of year. In some areas, gasoline prices can fluctuate by as much as 50 cents per gallon or more. EVs also have some interesting cost-related quirks. For example, the cost of charging an EV can vary depending on the time of day and the charging network you use. Some charging networks offer free charging during off-peak hours, while others charge a premium during peak hours. By understanding these fun facts, you can make more informed decisions about how to minimize your vehicle ownership costs.

How to Calculate Your Personal TCO

To calculate your personal TCO, you'll need to gather information about the specific vehicle you are considering and your individual driving habits. Start by estimating your annual mileage and the percentage of your driving that is done in city versus highway conditions. Research the fuel economy or energy consumption of the vehicle, and estimate the cost of gasoline or electricity in your area. Obtain insurance quotes from multiple providers and estimate your annual insurance premiums. Research the maintenance schedule and repair costs for the vehicle, and estimate your annual maintenance expenses. Factor in any applicable taxes, fees, and registration costs. Finally, estimate the depreciation of the vehicle over its expected lifespan. Once you have gathered all of this information, you can use a TCO calculator or spreadsheet to calculate your personal TCO.

What If... Scenarios Affecting TCO

Several "what if" scenarios can significantly impact your TCO. What if gasoline prices suddenly spike? This would increase the cost of owning a gasoline car, making a hybrid or EV more attractive. What if you experience an unexpected repair bill? This would increase the cost of owning any vehicle, but it could be particularly costly for an EV if it involves a battery replacement. What if you qualify for a significant tax credit or incentive for purchasing an EV? This would reduce the upfront cost of the EV, making it more competitive with gasoline cars. What if you decide to sell your vehicle sooner than expected? This would affect the depreciation cost and potential resale value. By considering these "what if" scenarios, you can better prepare for unexpected expenses and make more informed decisions about your vehicle ownership.

Listicle: Top 5 Ways to Save on Vehicle Ownership

Here’s a listicle of the top five ways to save on vehicle ownership: 1.Buy Used: Let someone else absorb that initial depreciation hit.

2.Drive Efficiently: Gentle acceleration and consistent speeds save fuel.

3.Maintain Regularly: Preventative maintenance avoids costly repairs down the line.

4.Shop for Insurance: Compare quotes annually to ensure you're getting the best rate.

5.Consider Alternative Transportation: Walk, bike, or use public transit for short trips to reduce mileage and wear and tear on your vehicle. These simple steps can have a significant impact on your overall TCO.

Question and Answer Section

Here are some frequently asked questions about the cost of ownership:

Q: Are EVs really cheaper to maintain?

A: Generally, yes. EVs have fewer moving parts than gasoline cars, reducing the need for oil changes, spark plug replacements, and other common maintenance tasks.

Q: How do I factor in the cost of charging an EV at home?

A: Check your electricity bill to determine your cost per kilowatt-hour (k Wh). Multiply that by the k Wh required to fully charge your EV battery to estimate the cost per charge.

Q: What about battery replacement costs for EVs?

A: Battery technology is improving, and warranties are becoming more comprehensive. While battery replacement is a potential expense, it's becoming less of a concern.

Q: Is it always cheaper to own an EV in the long run?

A: Not always. Factors like initial purchase price, electricity costs in your area, and driving habits can influence the outcome. Carefully calculate your TCO to make an informed decision.

Conclusion of Cost of Ownership: Comparing Hybrids to Electric Vehicles and Gas Cars

Choosing the right vehicle involves more than just comparing sticker prices. By understanding and calculating the total cost of ownership, considering factors like fuel/electricity costs, maintenance, insurance, depreciation, and potential incentives, you can make a well-informed decision that aligns with your financial goals and environmental values. While EVs and hybrids often present a higher initial investment, their lower running costs and potential tax benefits can lead to significant long-term savings. Taking the time to crunch the numbers and assess your individual driving needs will empower you to drive off the lot with confidence, knowing you've chosen the vehicle that truly offers the best value for your money.